Philosophy & Social Sciences

Out of Control: Humans are becoming more mechanicals and robots are becoming more biological. Out-of-controlness is the final destiny of robots and artificial systems, leading to self-control, adaptability, and creativity. This is also the ultimate outcome of human development. This is an amazing work by Kevin Kelly to explain how the natural world operates using hundreds of examples and citations.

The War of Art: I have just re-read the work from Steven Pressfield that talks about our biggest enemy, Resistance, how it tries to prevent us from achieving our life goals and transcendental forces beyond human perception. Definitely in my top 10 list.

Public Health

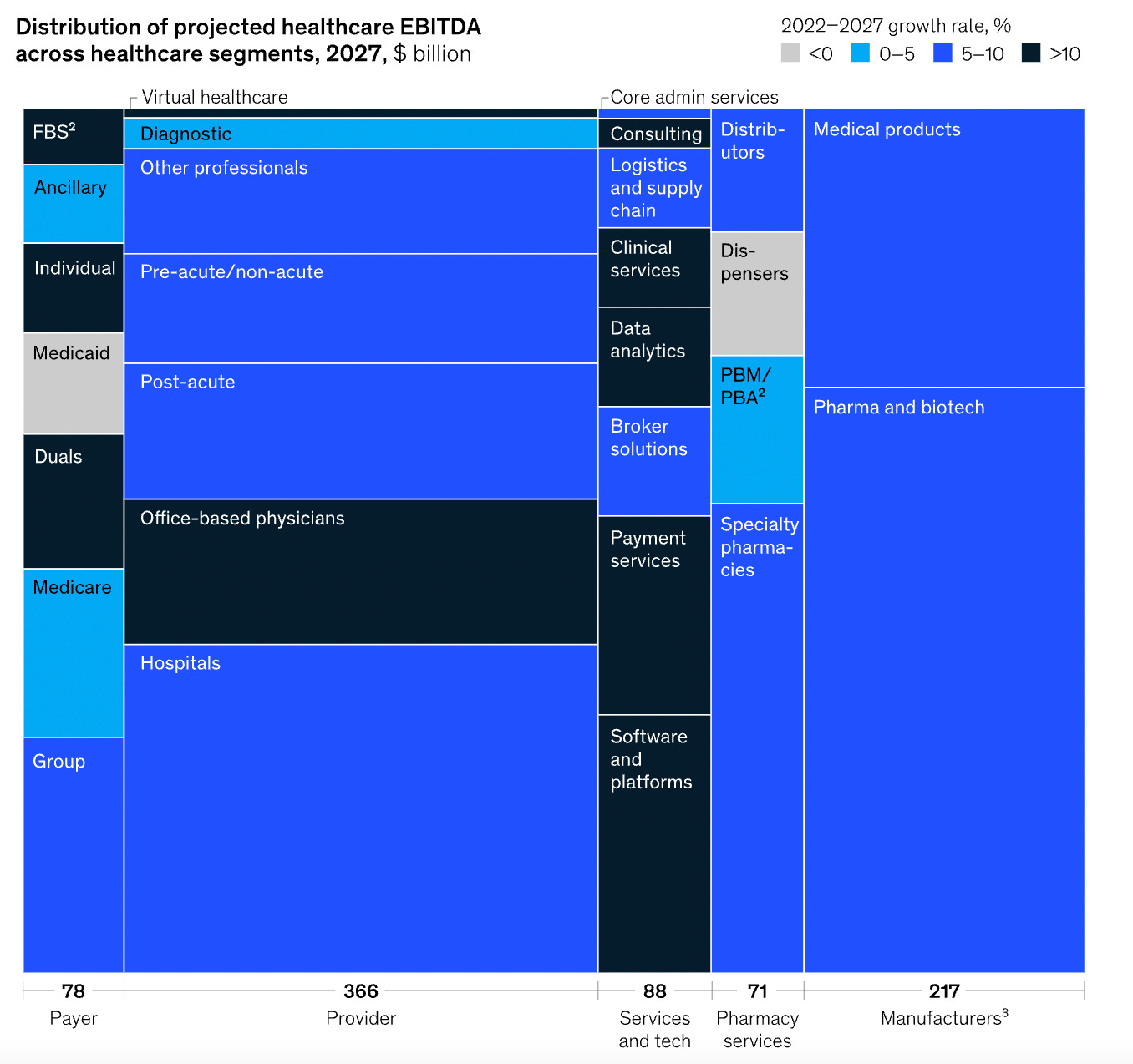

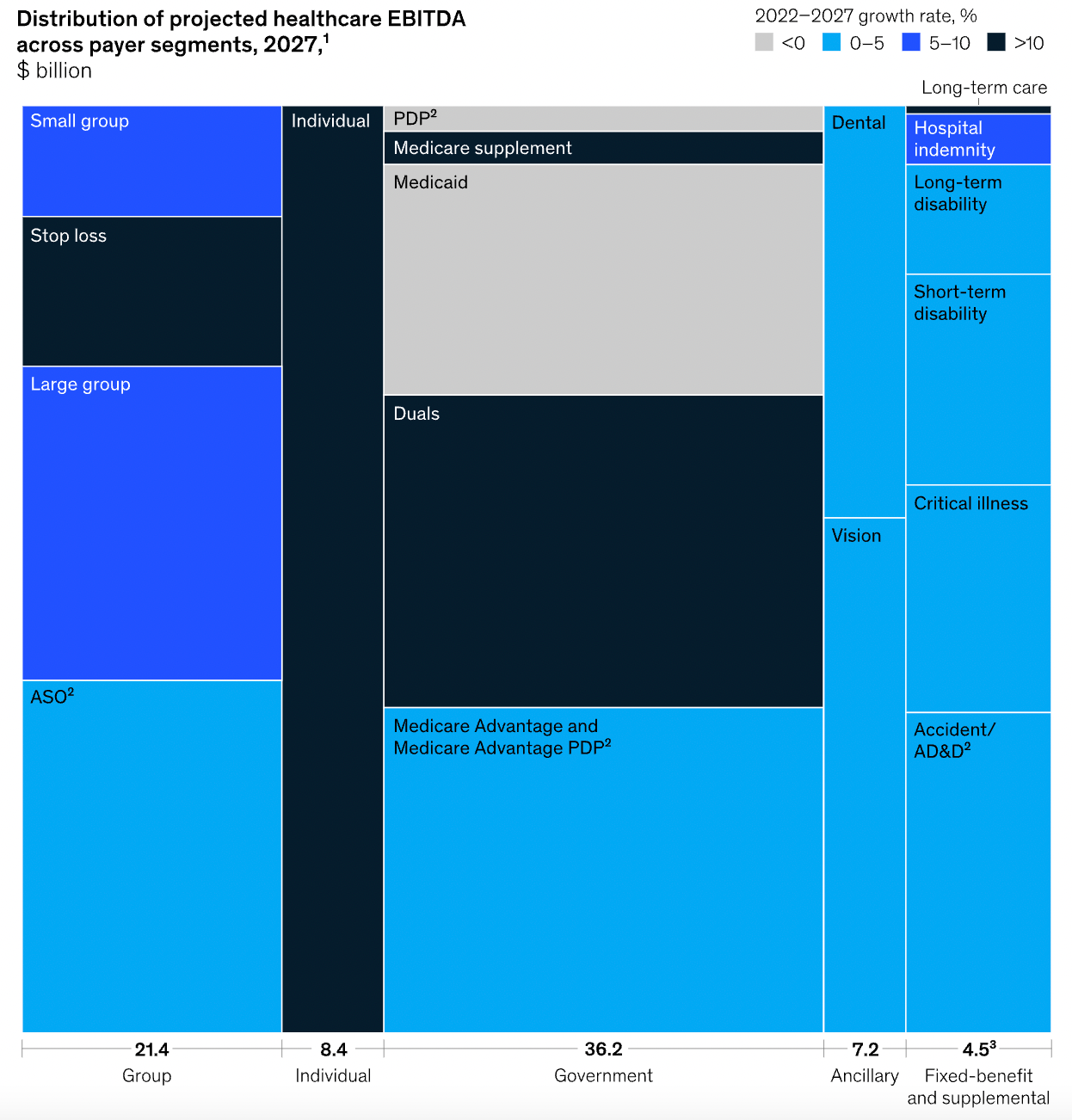

What to expect in US healthcare in 2024 and beyond:

Profits: continue to be pressured by inflation rates and labor shortages leading a 7% CAGR (2022-27). Nonetheless, some segments can expect higher growth in profit pools (black):

Within payer, Medicare Advantage, spurred by the rapid increase in the duals population; the group business, due to recovery of margins post-COVID-19 pandemic; and individual

Within health systems, outpatient care settings such as physician offices and ambulatory surgery centers, driven by site-of-care shifts

Within Healthcare Services and Technology (HST), the software and platforms businesses (for example, patient engagement and clinical decision support)

Within pharmacy services, with specialty pharmacy continuing to experience rapid growth

Others might face though times: Medicare, PBM, Pre and Post Acute

Factors that will likely influence profit pools:

Change in payor mixer:

Medicare Advantage: reduced enrollment in Medicare Advantage is expected from 2022 to 2027 leading to 5 percent annual growth, compared to historical rate of 9 percent from 2019 to 2022.

Dual population (individuals who qualify for both Medicare and Medicaid): 9 percent CAGR 2019 to 2022

Commercial segment: rebound expected by 2027 as EBITDA margins likely return to historical averages

Individual segment 27 percent CAGR from 2022 to 2027 as enrollment rises, propelled by enhanced subsidies, Medicaid redeterminations, and other potential favorable factors (for example, employer conversions through the Individual Coverage Health Reimbursement Arrangement offered by the Affordable Care Act)

Medicaid: enrollment could decline by about ten million lives over the next five years based on our estimates, given recent legislation allowing states to begin eligibility redeterminations (which were paused during the federal public health emergency declared at the start of the COVID-19 pandemic).

Accelerated value-based care (VBC):

McKinsey estimates: from 43 million people in VBC in 2022 to 90 million in 2027; tailwinds: increase in commercial VBC adoption, greater penetration of Medicare Advantage, and Medicare Shared Savings Program

Payers: Government segments are expected to be 65 percent larger than commercial segments by 2027

Health systems: spurred by transformation efforts, cost reduction strategies and potentially higher reimbursement rates, there is a expectation of 11 percent CAGR of EBITDA from 2023 to 2027 (still lower than 2019 levels).

HST: the fastest-growing sector in healthcare. McKinsey expects a 12 percent CAGR of EBITDA from 2022 to 2027. The sector is being fueled by lower wage pressure, continued adoption of technology, need for companies to implement operational efficiencies, and wiliness to pay for better systems.

Pharmacy services: the fastest-growing sector in healthcare. McKinsey expects a 12 percent CAGR of EBITDA from 2022 to 2027. The sector is being fueled by lower wage pressure, continued adoption of technology, need for companies to implement operational efficiencies, and wiliness to pay for better systems.

Biotech/ Pharma - notes from class:

Amazing scientific innovations: Microbiome, 3D printing, AI, CRIPR-CAS9

Increasing competitive intensity leading to fragmentation and shortened time to achieve goals

Continued sales growth in pharma amid uncertain global conditions and US drug price reform; Increase in Orphan drugs market

Biotech representation on total drugs prescribed grow from 24% in 2014 to 38% in 2021

Oncology is the dominant area for therapeutics for investments in therapeutics

Fundraising and deals stay strong, but exits are complex (M&A and licensing deals)

Jennifer Douda Lecture: 2 weeks ago I met Jennifer Doudna in a class at Berkeley. Last posted I mentioned about her work with CRISPR-CAS9 that has been changing life sciences forever.

Matthew Walker Lecture: The same class gave me the opportunity to watch a lecture from Matthew Walker, the author of the mind-blowing book Why We Sleep. This book made me rethink about self-awareness and self-care to continue pursuing my dreams. Sometimes you need to take a step back, to take two steps further.

Energy & Technology

Data Center: This year, I started to study about this industry in a part-time effort with a PE firm focused in Digital Infrastructure. This year I had the opportunity to delve deeper in Software and Data Center industry, giving me the foundation knowledge about the tech ecosystem in the US. Data Center industry is essential to support disruptive technologies such as Generative AI, 5G, cloud, edge quantum computing. Great resources to get familiar with it:

Finance & Economics

Lex Friedman interviewed Bill Ackman: nvesting, financial battles, Harvard, DEI, X, and free speech

See you,

RR